Who We Are

Our Vision

All people in Wisconsin have an affordable place to call home.

Our Mission

We help Wisconsin thrive by expanding access to affordable housing choices.

What we do

We use our financial strength and expertise to improve access to affordable housing options and expand economic prosperity for everyone in Wisconsin. We work collaboratively with others and leverage our collective resources to expand equitable and sustainable housing where people want to live, work, raise a family, and thrive.

Our Strategic Priorities

We put people first.

We do what only we were created to do.

We protect housing as a core human need.

How we do it

We use our vital resources to make affordable housing possible and act beyond expectation to ensure housing for generations because everything we do is about helping people prosper.

Our Strategic Goals

BE the authority on housing in Wisconsin.

INCREASE housing choices for people across the state.

CENTER human experience in operations and decisions.

WHEDA History

-

1972Wisconsin Legislature creates state housing authority and appropriates $250,000 to start operations.

-

1973

Program operations begin.

-

1974

First bond offering raises $27 million for multifamily loans.

-

1975

First housing authority to market bonds to finance Section 8 housing.

-

1976

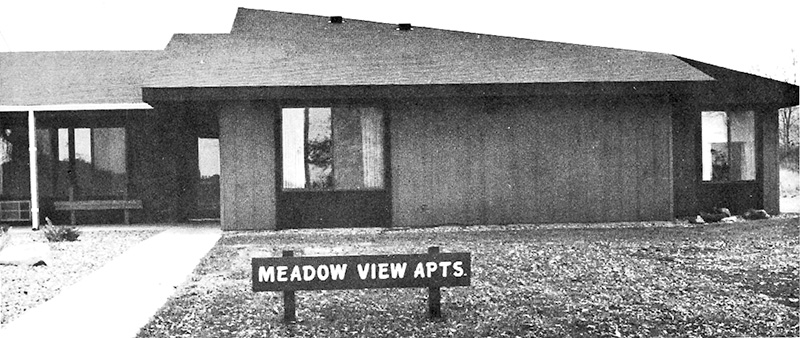

First housing authority to have newly constructed units in occupancy.

-

1977

First housing authority to coordinate housing with HUD and Farmers Home Administration.

-

1978

Authority-financed developments required to have units designed for people with disabilities.

-

1979

Repays $250,000 in initial seed money appropriated by the state.

-

1980

Issues first bonds for homeownership and single family rehabilitation loans.

-

1981

Receives $75 million in additional bonding authority for housing rehabilitation loans.

-

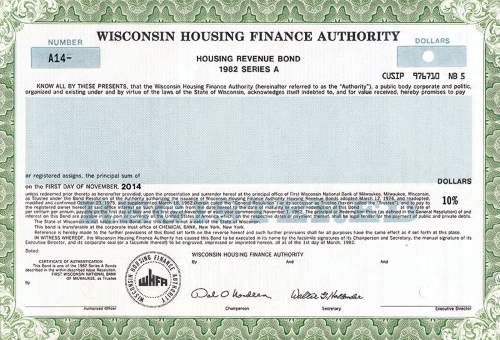

1982

Sells $100 million in mortgage revenue bonds to support first-time home buyers.

-

1983

Mission expands to include business and agriculture financing.

-

1984

WHEDA Foundation begins grant program to support non-profit housing providers.

-

1985

Launches the CROP loan guarantee to help cash-strapped farmers.

-

1986

Offers loan program to support women- and minority-owned businesses.

-

1987

Becomes first and only Wisconsin entity to administer federal housing tax credits.

-

1988

Offers a first-of-its-kind drought relief loan guarantee for farmers.

-

1989

Begins administering federal Section 8 rent vouchers.

-

1990

Surpasses $2 billion in total assets.

-

1991

Offers long-term financing along with federal housing tax credits.

-

1992

Leads the nation with over 4,500 single family loans financed by mortgage revenue bonds.

-

1993

The Wisconsin Preservation Trust is formed to help preserve Section 8 units as affordable.

-

1994

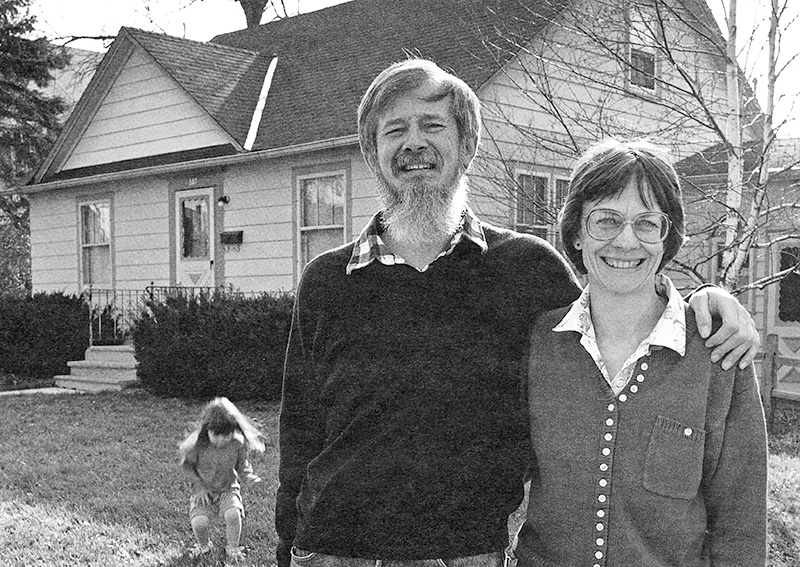

First housing authority to offer 97% LTV mortgages with private mortgage insurance.

-

1995

State Legislature permanently extends CROP financing for farmers.

-

1996

Introduces FARM loan guarantee to help farmers expand operations.

-

1997

Lindsay Heights partnership begins for Milwaukee neighborhood redevelopment.

-

1998

Provides temporary housing grants for flood and tornado victims.

-

1999

Closes more than $52 million in multifamily loans.

-

2000

Secures mortgage revenue bonding and tax credit programs with legislation to increase caps.

-

2001

-

2002

Closes more than $100 million in multifamily loans.

-

2003

Increases African American mortgage lending by 27%.

-

2004

First housing authority to be awarded federal New Markets Tax Credits.

-

2005

Record year with over $560 million in mortgage lending.

-

2006

Invests $4 million in Milwaukee's Metcalfe Park Neighborhood lease-to-purchase program.

-

2007

Awards housing tax credits on Tribal land.

-

2008

Launches WisconsinForeclosureResource.com to help homeowners.

-

2009

Receives $139 million in American Recovery and Reinvestment Act funds to advance housing.

-

2010

First housing authority to offer a mortgage product in partnership with Fannie Mae.

-

2011

Awarded $22.4 million in State Small Business Credit Initiative funds.

-

2012

Commits $100 million to Transform Milwaukee initiative.

-

2013

Announces Tax Advantage Mortgage Credit Certificate program.

-

2014

Launches no-fee loan guarantee to help Milwaukee small businesses.

-

2015

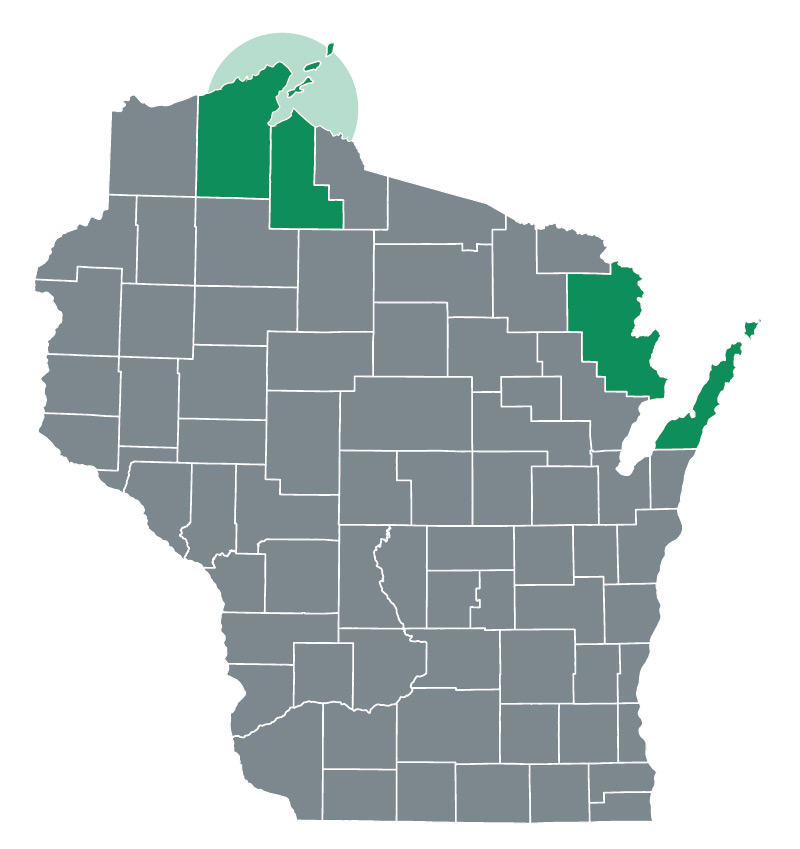

Introduces Veterans Affordable Loan Opportunity Rate mortgage program.

-

2016

Receives $5.47 million Capital Magnet Fund grant to increase affordable housing.

-

2017

Forms LISC partnership to expand small business financing resources.

-

2018

Begins administering the state housing tax credit program.

-

2019

Helps over 3,700 individuals and families achieve homeownership.

-

2020

Commits $10 million to rural affordable workforce housing.

-

2021

Forms CSH partnership to advance supportive housing.

-

2022

-

2023

Administers new loan products through the Bipartisan Housing Legislation Package to increase affordable housing options.